Here are the prices I paid per bottle (including shipping) from 2004 thru 2015:

$80, 80, 83, 84, 90, 90, 90, 97, 100, 104, 104, 110.

One might say it’s been under-priced for a very long time relative to others as well…

That looks like the SMF temperature gauge ![]()

I could see how it would be bittersweet after being on a list for so long. FWIW, once they stopped offering futures pricing at retail and went straight to mailing list, that was the end for me.

Surprised by your tasting room experience. We visited earlier this year and I received a healthy pour of the 2003 estate Cab which was delicious, and I paid for just a regular tasting.

Its been a few years since we have been there to taste. But we have had fabulous tours in the past. Our last trip, we did their food and wine pairing. Started with tasting their standard wines. Nice pours and helpful staff. Then went up to the apartment (amazing!) and had an incredible food and wine pairing that lasted about 2 hours.

I have had all their cabs back to the 73 . Purchased futures from distributors since the 86 release and then their future program since started. I am torn as I really enjoy their wines, but this is a big jump in price. However, it is still substantially cheaper than many/most high end Napa cabs. I will probably stay on their list, the only question is 6 or 12 bottles.

Sadly, purchasing retail is not an option for us as very little gets into our state. Ordering from one of the large Cali distributors ( as we used to do ) is no longer an option as they are not allowed to ship to our state.

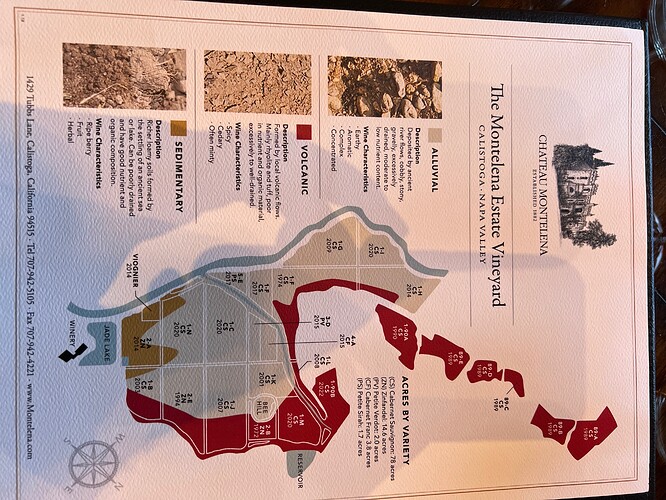

Speaking of replanting, I stopped by the winery yesterday to pickup and the below map shows block by block and when it was planted. Appears they replanted quite a bit in 2020.

Canceled yesterday after having been in the futures program since 2009, starting with the 2007 vintage. Wasn’t sure what to expect after receiving the recent letter from Bo giving the heads-up. But a 43% increase from one year to the next? And you still have to wait to get the wine you just paid for. That seems designed to drive a stake through the futures program. It worked. No thanks. Hard pass.

given the availability / pricing at retail and auction i would say its been priced reasonably against what the market will pay for this wine. 150 seems way off. Have to go back to 97 on WSPL for retail to be higher than this price

I usually don’t post here but was trying to find out the general sentiment of the (IMHO) a ridiculous futures prices hike. I can understand a 15 to 20 percent increase, but a 43% as another poster pointed out means it’s money grabbing at this stage and they don’t intend to support the futures program any longer. If that’s the intent it’s clearly going to work for me who’ve been a member since 2010. Yeah we get inflation and the fires, but a reasonable price hike is something I would say many members would still support.

Given the fact that the wines at retail upon release will likely be priced not much more than futures (historically at CA Costco it’s literally ~10% more), it’s no longer worth the upfront cost. Bo mentioned it will be priced at $225. Good luck with that if you aren’t getting WA 97+ scores. They are now literally 10 dollars less than Quilceda Creek by mailing list and I only need to wait max of 3 months for those wines. And guess what, they do well in the secondary market! That’s why ppl are on the list! Montelena doesn’t do well in the secondary market for a variety of reasons, but one of which is it has never been regarded with the same pedigree as others in Napa, let alone those in Bordeaux. As I have children now it has also been increasingly difficult to attend events, let alone even a tasting since the kids are literally going to burn the castle down …

It’s been living the name off its 1976 chard, not cab. Monte Bello arguably is a better wine as an example. Honestly I will happily contribute to the state of WA and Bordeaux for years to come with the same quality of wine at a lower price point

This just went from being fairly priced to outrageously priced. I wonder what percentage of Futures Members will drop off? I would be willing to guess that the phones have been ringing at the Estate!

https://www.klwines.com/Auction/Bidding/AuctionBidDetail.aspx?sku=1622577

So this is the market, Magnum of 2001, looks in great shape, for $260 after buyers premium…

Very true indeed. ![]()

So many older vintages of Napa wines ready to drink cheaper than current releases.

Well this is one data point on where the futures money should be spent.

In the end, I dropped out, can’t justify this kind of increase which feels like they are trying to cover the lost 2020 vintage. I was planning to buy a case as it’s my son’s birth year but I decided to take my chances at retail.

I’d love to know what the churn looks like after a price increase like this.

I keep chuckling at “the end of futures” every time I notice this thread. Could be a good name for a movie.

I keep thinking the REM song but insert futures for world. And I feel fine